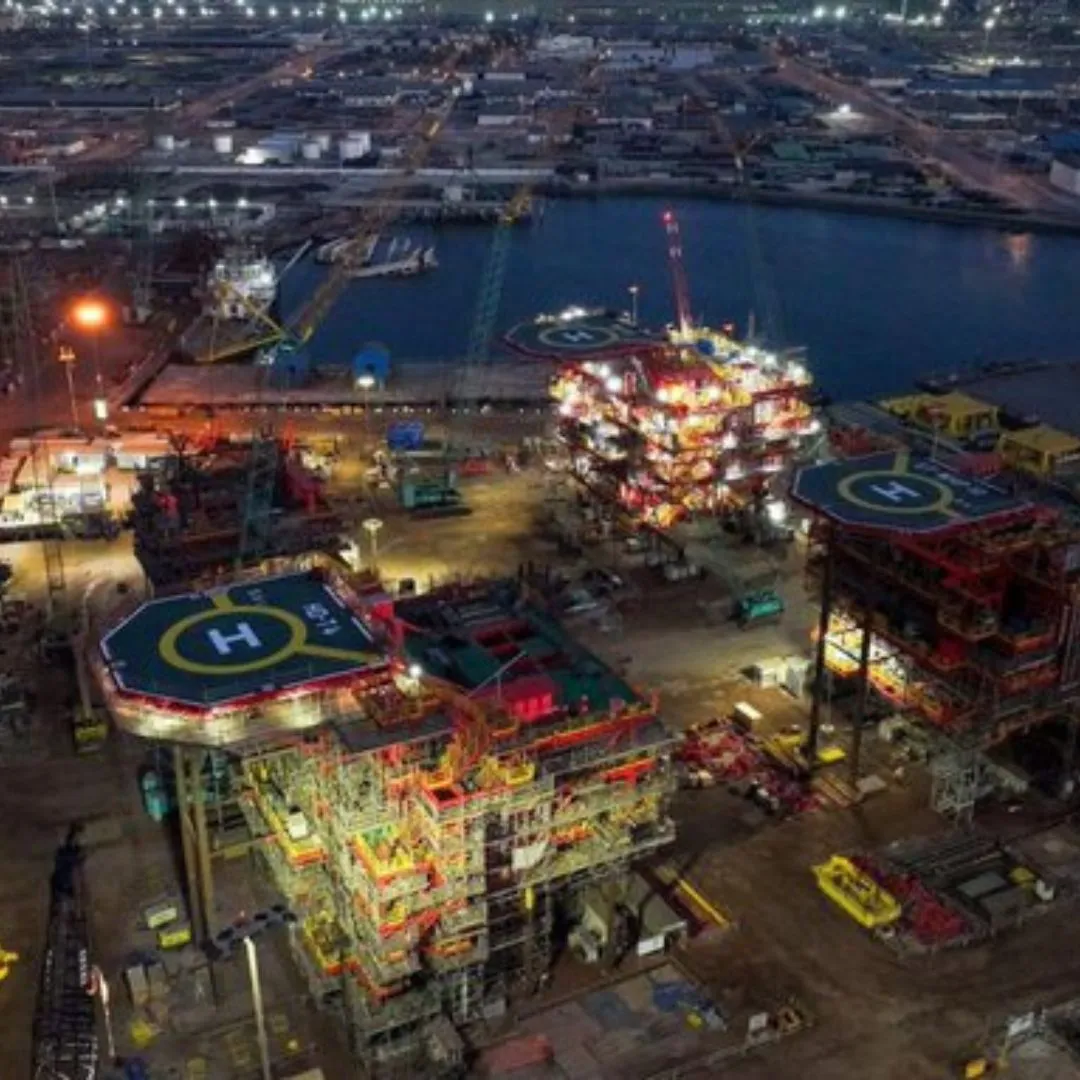

The recent Initial Public Offering (IPO) of NMDC Energy has garnered significant attention and excitement in the financial markets, as it was heavily oversubscribed by a factor of 14 within just four days. This remarkable level of oversubscription is a clear indicator of strong investor demand and high confidence in the company’s prospects.

An oversubscribed IPO occurs when the number of shares that investors want to purchase exceeds the number of shares available for sale. In the case of NMDC Energy, the fact that the IPO was oversubscribed 14 times means that the demand for shares far exceeded the supply. This level of interest suggests that investors are highly optimistic about the company’s future performance and growth potential.

Several factors likely contributed to this overwhelming demand. First, NMDC Energy operates in a sector that is increasingly vital to global economic development—energy. With the world moving towards more sustainable energy solutions and the growing importance of energy security, companies like NMDC Energy are well-positioned to benefit from these trends. Investors are likely attracted to the company’s potential to capitalize on these opportunities.

Second, the strong market interest could also be attributed to NMDC Energy’s business model, financial health, and strategic direction. Companies with solid fundamentals, clear growth strategies, and strong management teams tend to attract more investor interest during IPOs. NMDC Energy’s ability to present itself as a leader in the energy sector likely played a significant role in attracting such a large number of investors.

Additionally, the broader market environment may have contributed to the enthusiasm. Periods of economic stability and growth tend to boost investor confidence, leading to more robust participation in IPOs. The oversubscription could also indicate that institutional and retail investors alike are seeking new investment opportunities in sectors with long-term growth potential.

In conclusion, the heavy oversubscription of NMDC Energy’s IPO underscores the strong market demand and investor confidence in the company. It not only highlights NMDC Energy’s attractiveness as an investment but also reflects broader positive sentiments in the energy sector and the overall market. This successful IPO positions NMDC Energy well for future growth and expansion, with a solid base of investor support.